Germany's Schwarz Group, which operates Lidl and Kaufland, has been named as the leading grocery retailer in Western Europe by market research provider Euromonitor International.

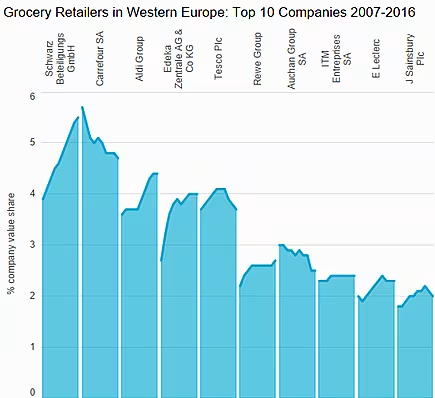

The organisation measured retailers' value share from 2007 to 2016, with Schwarz stores coming out on top, followed by Carrefour, Aldi, Edeka, and Tesco.

Schwarz Group did not rank first in any single market, however, the group has a presence in almost all Western European markets, with the exception of Norway and Turkey.

Market Dominance

All of the top 10 companies are headquartered in Western Europe, although US giant Walmart, which owns UK supermarket Asda, is ranked 11th.

In 15 of the 17 markets studied, a domestic company is the leading grocery retailer, with the exception of Greece and Austria.

According to Euromonitor, the grocery sector is dominated by the top five companies in the majority of Western European countries, which have a combined market share of 60% or higher.

In the Nordic countries, however, the top five have a market share of at least 80%, showing a preference for domestic retailers in these markets.

The UK was the only market where the dominance of the top five retailers decreased over the review period, with German discounters Aldi and Lidl experiencing exponential growth in the past ten years.

Retail Outlook

Looking at the retail outlook for 2016-2021, Euromonitor notes that Greece, Denmark, and the Netherlands are the only Western European markets forecasting negative growth in the grocery sector.

"The UK faces an uncertain future in the wake of Brexit which is likely to mean increased costs for grocery retailers who may pass these onto consumers ensuring any value growth in the market will be minimal," said Philip Benton, lead analyst at Euromonitor.

"Despite this, it remains the second largest market in Western Europe just behind France but ahead of Germany."

He notes that France has the largest grocery retailing market in terms of value sales due to the popularity of hypermarkets for purchasing both grocery and non-food items.

"Despite Germany having the largest population in Western Europe and reporting positive growth in the grocery retailing market, it is only ranked third," continued Benton.

"This is due to German consumers’ love of discounters and 'value for money' shopping which is a trend that has spread around Europe but keeps average spending at a much lower level in Germany versus France and the UK."

Overall, Euromonitor says that the popularity of discounters has stemmed the growth of value sales in the review period in several market, with shoppers switching from more expensive supermarkets.

"However," added Benton, "there has been a switch from leading discounter Lidl to be more “soft”, which will result in the premiumisation of products which could boost value sales growth once more.”

© 2017 European Supermarket Magazine – your source for the latest retail news. Article by Sarah Harford. Click subscribe to sign up to ESM: The European Supermarket Magazine.