The outlook for the European retail sector in 2021 is 'stable', a new report by Moody's Investors Service has said, with demand recovery set to be balanced by a margin dilutive online surge over the next 12 to 18 months.

The driving forces behind this stable outlook include a recovery in sales volumes and profits – although for many retailers they will remain below 2019 levels – as well as a normalisation of food demand and a more positive economic outlook.

“Our outlook for the retail sector across Europe for next year aligns with our expectations for continued sector sales volume and profit recovery, although they will still stay below 2019 levels,” commented Francesco Bozzano, vice president – senior analyst, at Moody’s Investors Service.

“That said, recovery will be much slower for retailers exposed to sectors like tourism and travel.”

Positive Or Negative

Should earnings growth top 4% over the next 12 to 18 months, or in the event of an effective vaccine rollout, Moody's said that its outlook for the sector could change to 'positive'.

At the same time, factors such as a delay in economic recovery, increased price pressure, and a continuation of lockdown measures without adequate government support for businesses, could similarly change Moody's outlook to 'negative'.

According to Moody's, the coronavirus pandemic is likely to 'speed up' retail sector transformation across Europe, particularly when it cones to the digitalisation of the sector.

It said that the rising share of online sales is cannibalising in-store sales and eroding margins for bricks-and-mortar focused retailers. In addition, the digitalisation of stores, marketing and sales initiatives is likely to entail additional costs at the outlay, before delivering improved efficiency.

Elsewhere, public health and safety concerns resulting from the COVID-19 pandemic, as well as growing inequality and social challenges, are likely to have 'substantial credit implications' for retailers next year, according to Moody's.

Profit Growth

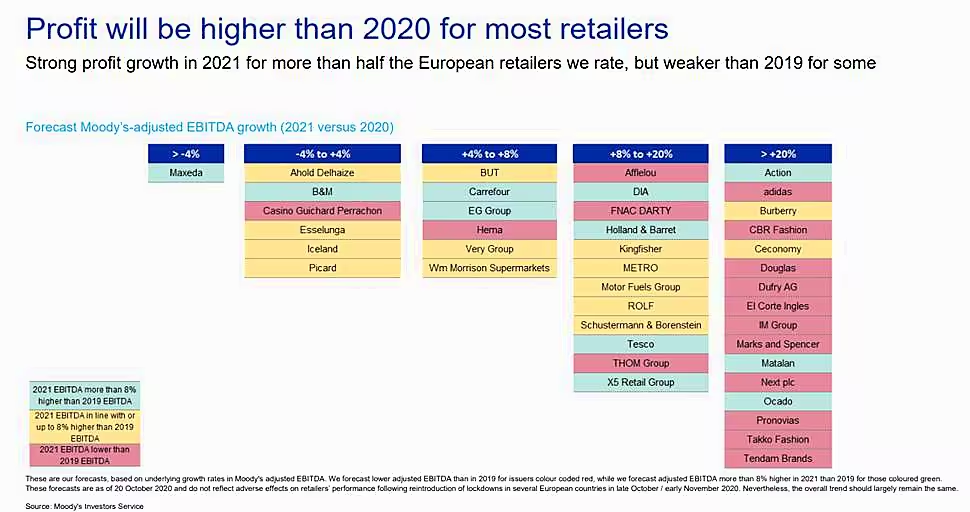

Among the retailers set to see strong year-on-year profit growth (more than 20%) in 2021 are Marks & Spencer and El Corte Inglés, Moody's noted, however in both cases its 2021 profit performance is likely to fall short of that recorded in 2019.

Retailers including DIA, Tesco and X5 Retail Group are likely to post profit growth of between 8% and 20% next year, while Carrefour is expected to see profit growth of between 4% and 8%. In each case, these retailers are expected to exceed their 2019 profit performance.

© 2020 European Supermarket Magazine – your source for the latest retail news. Article by Stephen Wynne-Jones. Click subscribe to sign up to ESM: The European Supermarket Magazine.