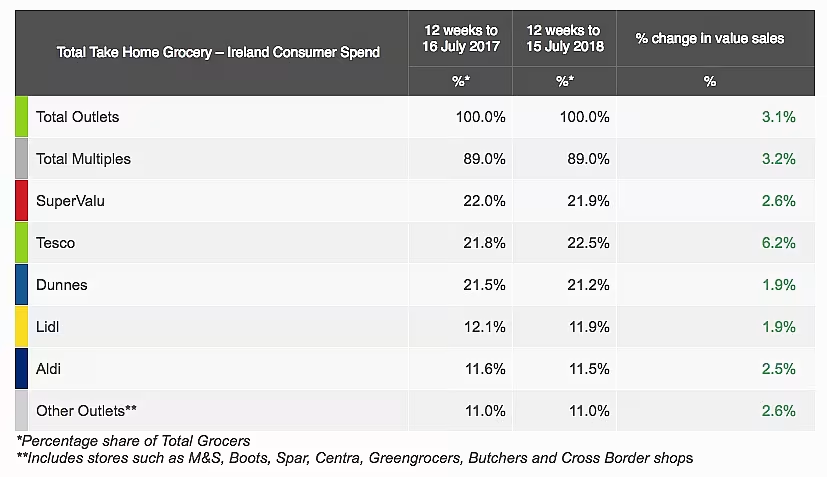

Tesco is now 60 basis points ahead of its nearest rival, at the summit of the Irish grocery market, according to the latest market share data from Kantar Worldpanel.

Data for the week ending 15 July 2018 puts Tesco on 22.5%, with the retailer having seen a 6.2% increase in value sales in the period.

Second-placed SuperValu sits on 21.9% share, having registered a 2.6% increase in sales, while Dunnes holds 21.2% of the market, following a 1.9% increase in sales.

Discounters Lidl and Aldi hold 11.9% and 11.5% of the market, respectively, putting their combined market share on 23.4%. Lidl's and Aldi's value sales growth in the period stood at 1.9% and 2.5%, respectively.

Flying Solo

As Kantar Worldpanel pointed out, Tesco was the only retailer to increase its market share in the period.

'With shopper numbers continuing to fall across most retailers, in-store marketing activity plays an increasingly important role in driving spend from existing shoppers,' the research firm noted.

'Tesco’s extensive Grillin' and Chillin' campaign saw it make a big push on key barbecue items, and products like ice cream, chilled poultry and chilled burgers all performed strongly, resulting in shoppers putting an average of 4.7% more items in their baskets on each trip,' the firm further noted.

SuperValu, too, was well positioned to take advantage of the fine weather, Kantar Worldpanel said, while Dunnes Stores has seen the value of its basket shop rise, with the average Dunnes basket now featuring 20 items, which is 5.7% higher than in the previous 12-week period.

Positive Sales Growth

Overall, sales were 31.0% higher during the period, which Kantar Worldpanel attributes to the good weather and the World Cup. Some categories, it noted, enjoyed an impressive rise – bottled water rose by 27.3% and lager was up by 11.6%.

"Irish shoppers bought bottled water on 1.8 million more occasions in the latest 12 weeks, compared to the same period last year, helping sales grow by over a quarter," commented Douglas Faughnan, consumer insight director at Kantar Worldpanel.

"Furthermore, a Europe-wide shortage of CO2 may have stifled sales of carbonated water, which grew at a third of the rate of still water, with retailers and manufacturers shifting their focus to stills, where necessary," added Faughnan.

On the growing beer sales, Faughnan said, "[Despite] Ireland’s association with stout, it is lager that is actually leading the way – 42.4% of households bought lager at least once in the past 12 weeks, as shoppers took advantage of the sun and the football.”

Grocery market inflation was down 0.5% in the period.

© 2018 European Supermarket Magazine – your source for the latest retail news. Article by Stephen Wynne-Jones. Click subscribe to sign up to ESM: European Supermarket Magazine.