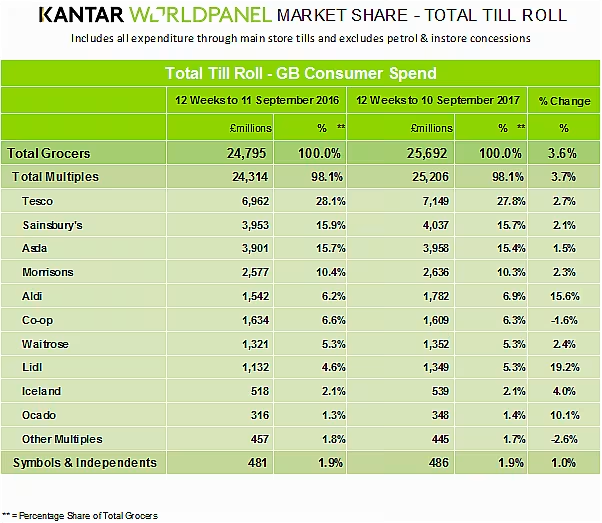

Tesco has outperformed the other 'Big Four' retailers in the UK market, growing by 2.7% in the 12 weeks to 10 September, to sit on 27.8% market share, according to the latest data from Kantar Worldpanel.

In contrast, Sainsbury's grew by 2.1%, to sit on 15.7% share, Asda grew by 1.5%, to sit on 15.4% share, and Morrisons grew by 2.3%, to sit on 10.3% market share for the period.

"Tesco’s recovery is becoming more entrenched,” said Fraser McKevitt., head of retail and consumer insight at Kantar Worldpanel. "Sales have grown continually since April this year and are up by 2.7% in the past 12 weeks, though the retailer’s market share remains under pressure, squeezed by 0.3 percentage points, to 27.8%.

"At Morrisons, volume sales have risen for the first time since January, and sales of its premium ‘The Best’ line are up 38% year on year, making it the fastest-growing premium range in a market where top-tier products are outperforming all other lines.”

Discounter Growth

The data also shows that the discounters continue to outperform the wider market.

Lidl is the fastest-growing retailer in the study. A sales increase of 19.2% has taken its market share to a record high of 5.3% – up 0.7 percentage points on last year.

Elsewhere, Aldi’s sales growth of 15.6% took its market share to 6.9%, cementing its position as the UK's fifth-largest retailer.

"Collectively, Aldi and Lidl now account for nearly £1 in every £8 spent in Britain’s supermarkets. A decade ago, this was only £1 in £25," McKevitt added. "In the past three months, almost 63% of shoppers visited one of the two retailers, up from a level of 58.5% last year.”

Despite the growth of the discounters, 98% of households still shopped in at least one of the traditional Big Four retailers over the same three-month period, Kantar Worldpanel noted.

Sales Increase

Overall, supermarket sales increased by 3.6%, compared to the same period last year, making this the sixth consecutive month in which sales have increased by more than 3%.

“We haven’t seen sustained market growth of this kind since May 2013,” said McKevitt. “A 1.5% increase in the volume of goods going through the tills has contributed to this growth, while the remainder of the overall sales increase is down to higher prices. Like-for-like grocery inflation now stands at 3.2%, slightly ahead of the headline CPI rate and down 0.1 percentage points on last month.”

© 2017 European Supermarket Magazine – your source for the latest retail news. Article by Stephen Wynne-Jones. Click subscribe to sign up to ESM: The European Supermarket Magazine.