Tesco has reported a 2.4% increase in group retail sales in the third quarter of its financial year, with sales over the Christmas period up 3.2%.

Commenting on its performance, chief executive Ken Murphy said that Tesco "outperformed the market, growing market share and strengthening our value position".

Here's how leading industry analysts viewed its performance.

Roberto Pozzi, Moody's

“Tesco’s market share gains both in stores and online translate into a modest operating profit guidance uplift for fiscal 2022, suggesting price competition amongst UK grocers remains intense.

"As rising inflation squeezes disposable incomes, we currently see limited upside for the sector’s profit growth and credit quality improvements over the next 12-18 months."

Clive Black, Shore Capital

"The Tesco investment thesis has evolved nicely since Ken Murphy took over as CEO during lockdown 2.0 int he UK in October 2020. Hamstrung by official controls and much uncertainty in his early months, most of which was outside his control, Tesco has evolved well in CY21 in our view as pandemic controls eased.

"Mr Murphy's new CFO, Imran Nawaz, started to have a positive effect, and the Group's trading strategy, which was largely put in place by the now Sir Dave Lewis, took hold. Whilst somewhat functional, Tesco's operating strategy is proving to be very effective, set around consistently high basic store standards and an evolving value proposition built on the core offer, Aldi Price Match, and increasingly, Clubcard Prices."

Kunaal Shah, GlobalData

"While sales in stores were positive, Tesco’s online sales dropped 12.2% against Q3 and Christmas FY2020/21. However, with the circumstances in 2020 having been unique, a decline was expected, and its two-year growth of 58.7% online indicates the retailer’s channel is still performing strongly.

"The expansion of its Tesco Whoosh rapid delivery service to 100 stores, a new trial partnership with rapid delivery specialist Gorillas, and the opening of its third urban fulfilment centre in Bradford next week will further strengthen Tesco’s online proposition and provide the channel with new growth opportunities during 2022.

"Consumers are facing further increases in cost of living this year, however Tesco is well placed to provide its shoppers with competitive pricing through its Aldi price match strategy and its Clubcard-only discounts. 95% of its promotional sales are now on Clubcard prices and 8.5 million customers access Clubcard via the app, contributing to a more loyal customer base which will continue to grow as consumers demand the best value for money during a period of squeezed disposable incomes.”

Nick Everitt, Edge by Ascential

“Data from Edge Retail Insight, Edge by Ascential’s industry-leading data forecasting and retail research portal, shows that in 2020, Tesco’s e-commerce sales grew 51% and grew another 19% in 2021 on the back of strong comparatives.

"This follows a noticeable increase in strategic digital investment under CEO Ken Murphy. The pressure will be on though for Tesco to maintain momentum, especially given the challenges associated with rising economic and living costs, as well as ongoing supply chain issues.

"Tesco’s Clubcard loyalty scheme has proven successful with customers and it is clearly keen to leverage this success through its newly launched Clubcard Pay+, a new debit card giving its 20 million Clubcard members shoppers the opportunity to allocate and budget grocery spend at the retailer.

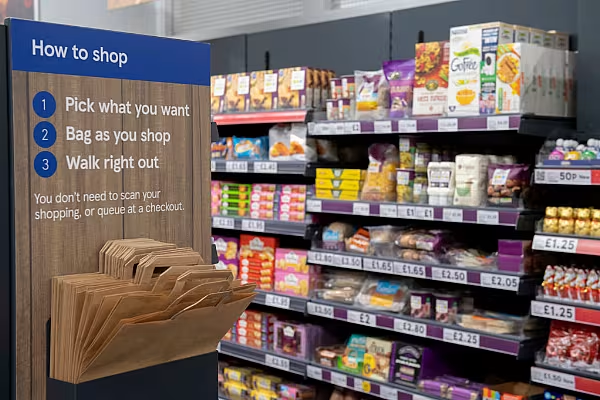

"Tesco will have to continue to set itself apart from its supermarket rivals. This includes continuing to invest in building out its frictionless experience via an expansion of its checkout-free stores, as well as strengthening its overall omnichannel offering."

Richard Lim, Retail Economics

“The retailer’s single-minded focus on competitive pricing and driving loyalty through its Clubcard-only discounts has won over customers this Christmas. The use of Clubcard has been a masterstroke from the retailer, enhancing the perception of value and playing on the hugely powerful customer instinct of FOMO - the fear of missing out.

“Online continued to deliver strong gains as a wave of new e-commerce converts stuck to a new way of getting their groceries over Christmas. Sales growth was mightily impressive in the wholesale part of the business with Booker seeing double-digit growth as catering and convenience boosted sales.

“Looking forward, the imminent squeeze on incomes will force many households into recessionary behaviours, trading down to own-brand and shopping around as they look to make budgets stretch that little bit further. Tesco is well placed to win new customers with their laser-like focus on value as they double-down on their Clubcard success.”

Russ Mould, AJ Bell

“Despite a strong Christmas and a small upgrade to forecasts, Tesco didn’t do enough to impress the markets, at least in early trading on Thursday However, there was still plenty to please long-term investors. The more focused strategy progressed under Dave Lewis and his successor Ken Murphy has helped deliver the supermarket’s highest market share in four years.

“Tesco’s online sales continue to track much higher than pre-pandemic levels. This is important as the greater scale in this part of the business is improving its profitability. Tesco is also pushing the loyalty angle, funnelling 95% of its promotions through its Clubcard scheme. This means investment in promotions has a double-whammy effect, increasing customers’ attachment to the brand as well as getting them through the doors in the first place.

“The challenge posed by the likes of Aldi and Lidl has changed somewhat from when they were complete upstarts; they’re now more mature businesses and therefore somewhat less agile than they were when they turned the sector on its head a few years ago.

“Inflation, as long as it is relatively mild and Tesco can keep tight control on its own costs, isn’t all bad news for the business and, with shopping for food economically insensitive, the company is looking well placed at the start of 2022.”

© 2022 European Supermarket Magazine. Article by Stephen Wynne-Jones. For more Retail news, click here. Click subscribe to sign up to ESM: European Supermarket Magazine.