In recent years, sustainability has become a buzzword in the fast-moving consumer goods (FMCG) industry, with consumers more aware of environmental issues, and a desire to buy products that are better for the planet. But is this translating into real growth for sustainable products?

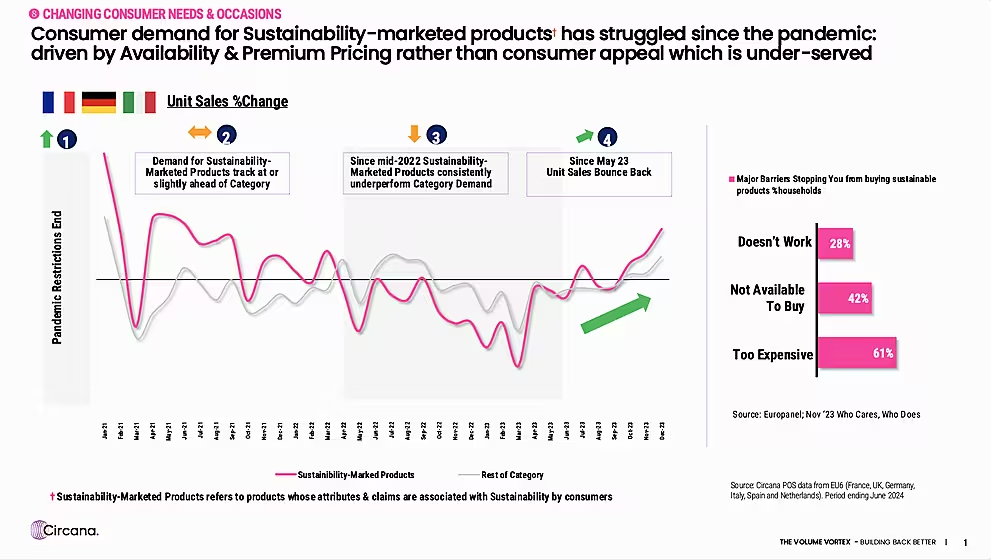

The demand for sustainability-marketed products—those with attributes and claims linked to sustainability—has struggled since the pandemic, primarily due to limited availability and premium pricing, rather than strong consumer appeal.

While from January 2021 to March 2022, these products tracked at or slightly above their category, they began consistently underperforming in mid-2022. However, by May 2023, unit sales started to rebound, offering a glimpse of recovery.

A recent study from Circana titled Sustainability: Hard Truths in the Race for Growth delves into this question, revealing surprising insights into the dynamics of sustainable product demand, particularly in Europe.

Sustainable Products

Despite the growing conversation around sustainability, Circana's research highlights a paradox in the European FMCG market. While nearly 68% of European consumers express a desire to buy environmentally friendly products, only 14% prioritise sustainability in their purchasing decisions.

This disconnect is reflected in the sales performance of sustainably marketed products, which have consistently underperformed compared to the wider FMCG category since mid-2022.

Previously, sustainable products tracked ahead of or on par with the market. However, rising prices, inflationary pressures, and the economic fallout from global events have shifted consumer priorities.

With cost-of-living concerns at the forefront, the top consideration for 68% of European consumers is now price, followed by health-related factors. This trend highlights the challenge for retailers selling sustainable products, as they need to convince price-sensitive consumers to pay a premium for environmentally friendly options.

Other research sheds light on the key barriers preventing more widespread adoption of sustainable products. Over 60% of households cite high prices as the primary obstacle, while 42% point to limited availability, and 28% express concerns about product performance.

These challenges highlight a critical gap in serving consumer interest, leaving room for growth if brands can address these barriers effectively.

With sustainability back on the rise, the opportunity for brands to meet consumer expectations has never been more crucial.

Availability Dilemma

One of the key barriers to the growth of sustainable products is availability. Many manufacturers and retailers assume that price is the main hurdle for consumers when it comes to purchasing sustainably, but Circana’s research paints a different picture.

The limited distribution of sustainable products is proving to be a significant challenge. When sustainable options aren’t readily available on shelves, consumers are often left with no choice but to purchase non-sustainable alternatives.

According to Circana, less than 20% of shoppers will search for a product if it isn’t immediately available, and 23% will simply opt for a different brand if they cannot find what they’re looking for.

The physical presence of sustainable products in stores is crucial for retailers to drive sales, especially for new product launches. Retailers and manufacturers that fail to ensure their sustainable products are on shelves are effectively losing out on potential repeat purchases, further stalling demand.

Role Of Retailers

While consumer demand for sustainable products has not yet reached its full potential, retailers are increasingly taking the lead. Circana’s research reveals that 92% of European retailers surveyed by the European Commission expect sales of sustainable products to grow faster beyond 2023.

This optimistic outlook is driven in part by regulatory pressure. Regulations, such as the European Commission’s 'Ecodesign for Sustainable Products Regulation' (ESPR), which was introduced in March 2022, aims to make products placed on the EU market more sustainable by improving their design.

It requires brands to meet stricter sustainability standards across various aspects of product sourcing, ingredient traceability, energy usage, and waste reduction.

Retailers are also capitalising on the growing trust that consumers have in private label brands. Two-thirds (66%) of consumers believe that private labels are as sustainable as national brands, with 25% viewing them as even more sustainable.

As a result, private labels are gaining market share, now accounting for 39% of grocery sales in the EU6 (the six largest FMCG markets in the European Union). This trend is likely to continue as retailers increasingly prioritise sustainable products to meet regulatory requirements and consumer expectations.

Power Of Packaging

One area where sustainability has made a significant impact is packaging. Reducing plastic waste and increasing the use of recyclable materials has become a mainstream priority for both brands and consumers.

Nearly half (48.3%) of European consumers have purchased fewer products packaged in plastic over the past year, signalling growing demand for environmentally friendly packaging solutions.

In countries like Spain, France, and Germany, packaging sustainability is influencing purchasing decisions. For example, 55% of Spanish consumers have chosen a brand specifically because of its sustainable packaging, while 51% of French consumers and 43% of German consumers have switched brands due to packaging concerns.

The examples of Most Wanted Wine and Cano Water show how brands and retailers can collaborate on joint sustainability initiatives that drive both commercial success and environmental benefits.

By prioritising sustainable packaging, such as the shift from bottles to cans, these brands align with consumer trends that favour eco-friendly products. Their efforts not only reduce waste but also appeal to individual consumption patterns.

Retailers can play a key role in supporting and amplifying these initiatives. By cooperating with brands on joint promotions, in-store visibility, and targeted marketing campaigns, they can help stimulate demand for sustainable products.

For instance, Most Wanted Wine and Cano Water could partner with retailers to highlight their environmental commitments through point-of-sale displays, shelf-space prioritisation, or exclusive promotions tied to sustainability.

Such collaborations would help educate consumers on the benefits of choosing eco-friendly options, while also reinforcing the retailer's commitment to sustainability.

Furthermore, retailers can support these brands by offering sustainability-related promotions, such as discounts on bulk purchases of eco-friendly products, or by integrating these items into storewide initiatives focused on reducing plastic use or supporting local sourcing.

By working together, retailers and brands can encourage consumers to make more sustainable choices, while simultaneously boosting brand loyalty and driving sales. This cooperative approach strengthens both the brand’s sustainability narrative and the retailer’s appeal to environmentally-conscious shoppers.

Greater Transparency

As manufacturers and retailers continue to push their sustainability agendas, they must be cautious about how they communicate their efforts. Greenwashing is a practice where products make vague or misleading claims about their environmental credentials.

According to a 2020 study by the European Commission, more than half of green claims (53%), have been found to be unclear, misleading or unsubstantiated, while 40% lacked any supporting evidence. These findings led to the development of the European Green Claims Directive in March 2023.

In the UK, for example, the Advertising Standards Authority (ASA), is cracking down on misleading environmental claims, reinforcing the importance of transparency in marketing. Brands that fail to clearly communicate their sustainability efforts risk losing consumer trust, which can have long-term implications for brand loyalty.

The Next Step

Consumer demand for sustainable products will pick up as economic conditions stabilise and sustainability becomes a more integrated part of consumers' values.

Younger consumers, particularly those under 40, are driving this shift. For them, sustainability is not just a nice-to-have but a non-negotiable part of their purchasing decisions. They see innovation as a key advantage for brands, making it an important tool for keeping them engaged and interested.

Circana's February 2024 report, 'The Volume Vortex: Building Back Better', highlights the top factors driving consumers in the EU, US, and South Africa to try new brands.

While price (44%), and promotions/deals (40%), remain the leading reasons, sustainability is becoming more influential. A notable 29% of consumers opted for plant-based alternatives, 27% were drawn to brands perceived as socially responsible, and 26% chose new brands because they were considered better for the environment. This shift signals growing consumer interest in ethical and sustainable choices alongside traditional value drivers.

Retailers that want to succeed in this evolving landscape will need to prioritise sustainability across their entire product range. This means going beyond isolated green initiatives and embedding sustainability into product development, marketing, and distribution strategies. By doing so, brands can build loyalty and position themselves for long-term growth in a market that increasingly values environmental responsibility.

While the demand for sustainable products in Europe is currently constrained by factors like price and availability, there is significant potential for growth. Retailers are leading the charge, driven by regulatory changes and consumer trust in private label brands.

As the market evolves, brands must focus on making sustainability a core part of their identity, ensuring transparency in their communications, and addressing the logistical challenges that are holding back sustainable products.

Sustainability holds significant commercialisation potential for both retailers and FMCG brands, but to fully tap into this opportunity, businesses must align their marketing claims with assortment optimisation.

Real success will come when marketing claims are credible, assortment is optimised, and products genuinely deliver on their sustainable promises. Brands that align these elements are more likely to drive growth, build loyalty, and maintain a competitive edge.

Visit www.circana.com to learn more.

This article was written in partnership with Circana.