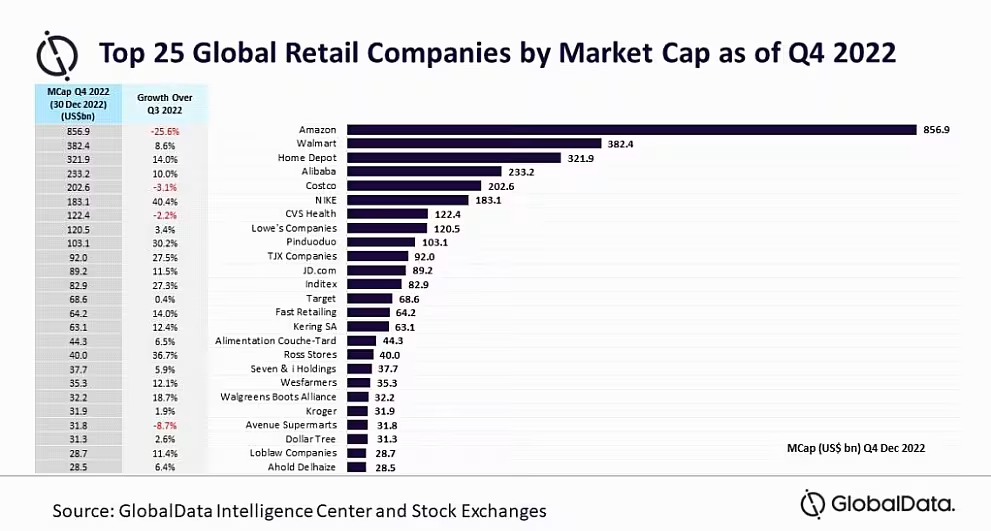

The world's top 25 retailers saw a 1.3% quarter-on-quarter decline in their cumulative market capitalisation, from $3.37 trillion (€3.1 trillion) in the third quarter of 2022 to $3.33 trillion (€3.08 trillion) in the fourth quarter, according to data and analytics firm GlobalData.

The decline was mainly driven by excess inventory as exponential inflation, interest rate hikes and increased recession fears changed the consumer behaviour.

Amazon, Costco, CVS Health and Avenue Supermarts were among the top 25 companies to report a significant drop in their market capitalisation in the fourth quarter, whereas Nike, Ross Stores and Pinduoduo gained considerably, data showed.

Ragupathy Jayaraman, business fundamentals analyst at GlobalData, commented, "The global retail industry is facing headwinds in the form of interest rate hikes and inflationary pressures.

"Increasing inventories and supply chain risks are also casting doubt on the growth prospects of the sector. Contrarily, the retail industry is looking towards changing trends such as omnichannel shopping, social commerce, and technological innovation."

Market Capitalisation Decline

In the last quarter of 2022, Amazon lost $294.3 billion (€272 billion) compared to previous quarter, its biggest decline in almost two decades.

The company’s performance was impacted by various factors, such as supply chain issues, the war in Ukraine and higher costs, as well as growing preference to in-store (offline) shopping, which also impacted most of the e-commerce retailers overall.

Elsewhere, Nike emerged as the biggest gainer among the top 25 global retail stocks, with a 40.4% quarter-on-quarter growth in the fourth quarter of 2022.

Jayaraman explained, "Retail giants Ross Stores, TJX, Pinduoduo and Inditex reported more than 25% growth in their market cap in the fourth quarter. More than 80% of the top 25 global retailers reported growth in their valuation.

"Although home improvement projects dwindled in the US, Home Depot was able to post a 14% quarter-on-quarter growth in valuation in the fourth quarter of 2022. Alibaba reported more than 10% growth in its valuation in Q4 2022, thanks to its cost optimisation initiatives and improved operating efficiency."

© 2023 European Supermarket Magazine – your source for the latest retail news. Article by Dayeeta Das. Click subscribe to sign up to ESM: European Supermarket Magazine.