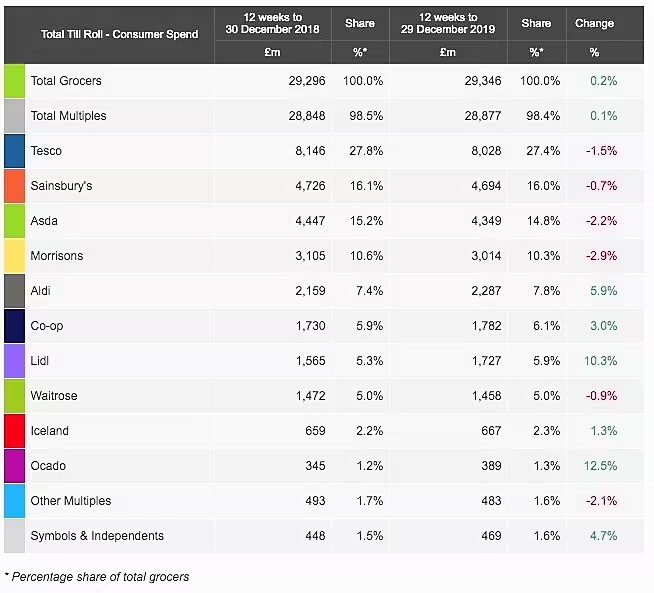

Britain's grocers saw sales grow by just 0.2% during the 12 weeks to 29 December, the latest market share data from Kantar has revealed, the slowest rate of growth over the festive period since 2015.

Grocery sales totalled £29.3 billion (€34.5 billion) during the so-called 'golden quarter', Kantar said, which was up £50 million on the previous year, however the overall performance of the sector was still disappointing.

“There was no sign of the post-election rush many had hoped for in the final weeks before Christmas, with shoppers carefully watching their budgets," commented Fraser McKevitt, head of retail and consumer insight at Kantar. "In fact, many of us cut back on traditional and indulgent festive classics."

As McKevitt noted, Christmas pudding sales dropped by 16%, season biscuits were down 11%, sparkling wine sales were down 8%, and even turkey sales were down 1%, with shippers switching to smaller and cheaper joints.

Big Four

With the overall sector posting marginal growth, it's not surprising that the UK's 'Big Four' supermarkets also found the going tough.

Market leader Tesco, which holds 27.4% of the market, saw sales drop 1.5%, Kantar said, while Sainsbury's (16.0%) saw a sales decline of 0.7%.

Third-placed Asda, which holds 14.8% share, saw sales down 2.2%, while Morrisons (10.3%) saw sales dip 2.9% during the period.

Best Of The Rest

Away from the Big Four, however, a number of grocers put in a strong performance. Aldi (7.8% market share) saw a 5.9% increase in sales, while Lidl (5.9%) saw a 10.3% increase in sales, as the discounters continued their solid performance to take their highest ever combined Christmas market share.

“At the end of the decade, it’s worth remembering just how quickly Lidl and Aldi have grown," said McKevitt. "Their current combined market share of 13.7% is more than treble what they held in December 2009, an unprecedented increase over the course of ten years.”

Ocado also put in a solid performance, growing by 12.5%, with the online-only operator now holding 1.3% of the market.

The Co-operative (6.1% market share) saw sales up 3.0% in the period, with Iceland (2.3% share) seeing sales grow 1.3%, boosted by a recent newspaper couponing campaign. Upmarket operator Waitrose (5.0% market share) saw sales down 0.9%, however.

Overall, average household spending over the 12 weeks fell by £8 to £1,055, while total volume sales fell by 0.7%. Grocery inflation for the 12-week period stood at 0.9%.

© 2020 European Supermarket Magazine – your source for the latest retail news. Article by Stephen Wynne-Jones. Click subscribe to sign up to ESM: The European Supermarket Magazine