British grocery inflation eased to its lowest level in a year heading into September, industry, providing some relief for consumers hurt by high prices and for the government, which has pledged to bring prices down.

Market researcher Kantar said annual grocery inflation was 12.2% in the four weeks to September 3, down from 12.7% in its August report.

It said prices are rising fastest in foods such as eggs, sugar confectionery and frozen potato products.

Continued Fall In Inflation

“Grocery price inflation is down for the sixth month in a row, but 12.2% won’t be a number to celebrate for many households," Fraser McKevitt, Kantar's head of retail and consumer insight, said.

He noted the researcher's data shows that 95% of consumers are still worried about the impact of rising grocery prices, matched only by their concern about energy bills, while just under a quarter of the population consider themselves to be struggling financially.

The Conservative government's key economic pledge to halve inflation in 2023 ahead of a probable election in 2024 is being challenged by stubbornly high food inflation.

The recent downward trajectory is being closely watched by consumers, lawmakers and the Bank of England as it mulls further rises in interest rates.

All of the country's major grocers have cut the prices of some staple products in recent months, with Waitrose and Aldi the latest to do so this week.

The Kantar data going into September provides the most up-to-date snapshot of UK grocery inflation. Official data published last month showed overall inflation in July was 6.8%, with food inflation at 14.9%.

Kantar said UK grocery sales rose 7.4% over the four-week period on a value basis.

Read More: UK Consumer Spending Growth Slows In August: Barclays

Strongest Performers

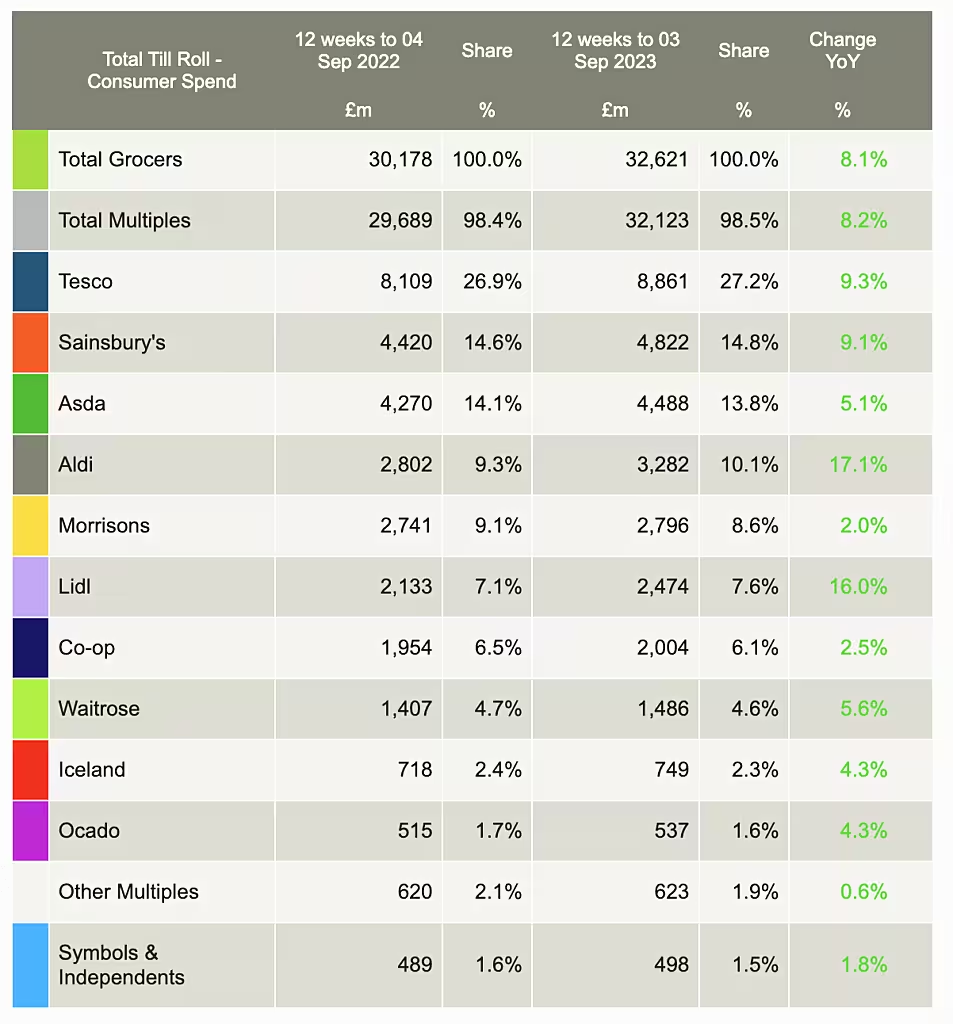

Discounters Aldi and Lidl were again the fastest growing grocers over the 12 weeks to September 3, with sales up 17.1% and 16.0%, respectively.

"The discounter model of offering everyday low value and fewer promotions has also caught on in the wider market, with only 26% of spending now on deals compared with 38% ten years ago," McKevitt added.

Market leader Tesco (which holds a 27.2% share of the market) saw its sales rise 9.3% in the period, while Sainsbury's saw sales up 9.1% and Asda reported a 5.1% sales increase.

Additional reporting by ESM