British grocery inflation hit 4.3% in February, market researcher Kantar has said, warning more pain for consumers was likely from ongoing supply chain pressures and the potential impact of the conflict in Ukraine.

Apart from the start of the COVID-19 pandemic, when UK supermarkets cut promotional deals to maintain product availability, February's inflation rate is the fastest Kantar has recorded since September 2013, leading to a 'cost of living squeeze'.

It said prices are rising fastest in markets such as savoury snacks, fresh beef and cat food, while falling in bacon, beer and lager, and spirits.

Britain's overall annual rate of consumer price inflation (CPI) rose to 5.5% in January, the highest since March 1992.

The Bank of England expects overall CPI to peak at around 7.25% in April when regulated household energy tariffs rise by more than 50%.

However, some analysts believe the economic fallout from Russia's invasion of Ukraine could result in inflation surpassing that forecast.

Grocery Sales Down 3.7%

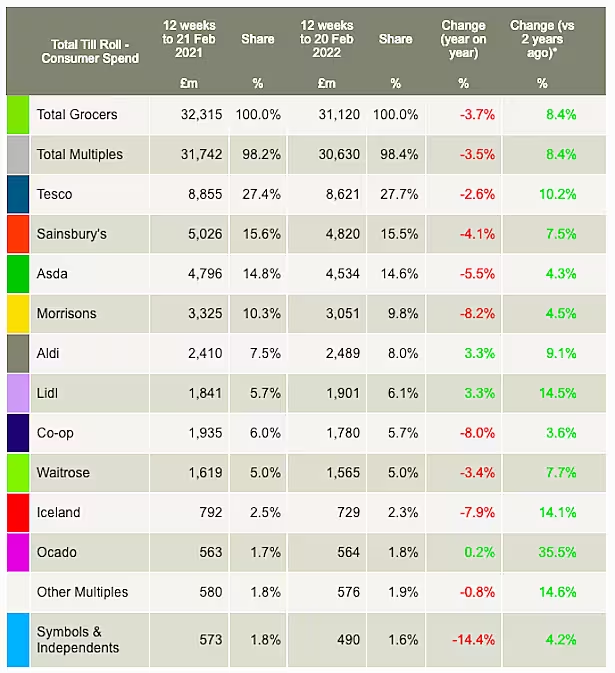

Kantar said UK take-home grocery sales fell 3.7% over the 12 weeks to Feb. 20 year-on-year, but were 8.4% higher than the same period before the pandemic in 2020.

The annual decline reflected last year’s pandemic lockdown when people were eating more meals and snacks at home.

"With the formal end to COVID restrictions in England, more of us are now eating on the go, buying sandwiches, salads and snacks on our lunch breaks, and enjoying meals out with friends and family," said Fraser McKevitt, Kantar's head of retail and consumer insight.

'Big Four Performance'

Market leader Tesco was again the best performer of Britain's big four supermarket groups, extending its run of market share gains. Tesco's chairman John Allan recently warned of looming inflation concerns over the coming year.

While its sales fell 2.6% over the 12 week period year-on-year, rivals Sainsbury's, Asda and Morrisons saw declines of 4.1%, 5.5% and 8.2% respectively.

All four saw sales gains on a two-year basis, with Tesco up 10.2%.

German-owned discounters Aldi and Lidl did better than the big four, both recording year-on-year sales gains of 3.3%.

Kantar said online sales accounted for 13.3% of all spending, down 2.1 percentage points from last year.

News by Reuters, edited by ESM – your source for the latest Retail news. Click subscribe to sign up to ESM: European Supermarket Magazine.