UK grocery inflation edged lower this month, data from market researcher Kantar showed, after rising for the first time in 18 months in last month's report.

It said annual grocery price inflation was 1.7% in the four weeks to Sept 1, versus 1.8% in the previous four-week period.

Rising Costs

Despite the fall, close to three fifths of UK households remained worried about the rising cost of their shopping, Kantar said.

“Despite grocery price inflation easing back to 1.7% over the last four weeks, shoppers' financial confidence hasn’t risen with it," commented Fraser McKevitt, head of retail and consumer insight at Kantar. "Memories of the last two years remain strong, with nearly 60% of shoppers still very or extremely concerned about rising grocery prices. This is their second biggest financial worry, only behind home energy bills."

The data showed prices were rising fastest in markets such as vitamin and mineral supplements, chilled fruit juices and chocolate confectionery, and were falling fastest in toilet tissue, dog food and bottled cola drinks.

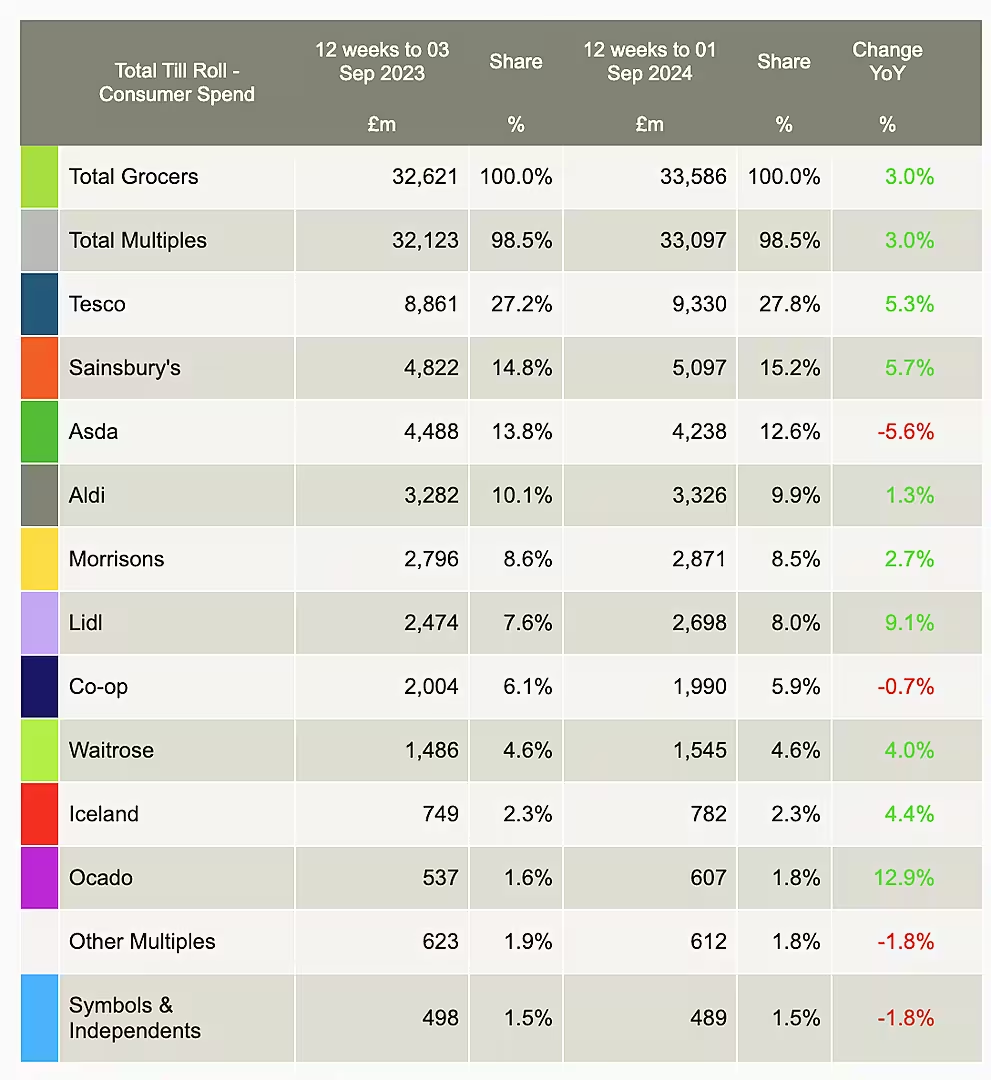

Kantar's data, the most up-to-date snapshot of UK consumer behaviour published since the July 4 national election, showed grocery sales rose 3.0% in value terms over the four week period year-on-year, a slight slowdown from growth of 3.8% in last month's report.

Ocado The Fastest Growing

Over the 12 weeks to 1 September, online supermarket Ocado was again the fastest growing grocer with sales up 12.9% year-on-year, its best rate of growth since May 2021, Kantar said.

Market leader Tesco saw growth of 5.3%, while sales at No. 2 Sainsbury's rose 5.7%.

No. 3 Asda was again the laggard, with sales down 5.6% and it lost 1.2 percentage points of market share year-on-year.

Discounters Aldi and Lidl saw sales growth of 1.3% and 9.1% respectively.

Aldi said on Monday its limited sales growth reflected its move to reduce prices ahead of the market.

Additional reporting by ESM