Grocery price inflation in the UK remained steady on a year-on-year basis at 3.3% in February 2025, helped by promotional campaigns by retailers, according to the latest data from Kantar.

Spending on promotions increased with items bought on offer accounting for 27.6% of sales, reflecting an increase of 0.3 percentage points compared to February 2024.

Premium own-label brands continued to enjoy popularity, registering year-on-year growth of 13.3% in February as shoppers focused on cost-effective ways to treat themselves.

Take-home grocery sales increased 3.6% over the four weeks to 23 February compared to the year-ago period.

Impact Of COVID-19

Kantar also analysed the evolution of consumers’ grocery purchasing habits ahead of the fifth anniversary of the first COVID-19 lockdown.

Sally Ball, head of retail at Kantar, commented, “Back in 2020, we didn’t know just how big an impact the COVID-19 pandemic would have on our lives, but five years on we can get a picture of its lingering effects on consumers. We haven’t gone back to old patterns and shopping trips remain below pre-pandemic times.”

In February 2025, British shoppers made one less visit to the supermarket than in 2020, while the market share of online shopping stood at 12.3% compared to 8.6% in February 2020.

Ball added, “One of the most interesting changes has been a move to simpler eating habits as we look for convenient shortcuts to make our lives easier.

“People are taking less time to prepare meals, and prep time in the evening, for example, has declined from almost 34 minutes in 2020 to 31 minutes in 2024.”

Moreover, data revealed that people are now using fewer different ingredients when making food, both at lunch and in the evening.

Consumers have also cut down on snacking with only 330 million occasions reported in 2024 by households versus 2020, according to the Kantar Worldpanel Usage – Total Food and Drink survey.

The survey compared the 52 weeks to 29 December 2024 with the comparable period in 2020 with a sample size of 4,000 households across Great Britain.

Top Retailers

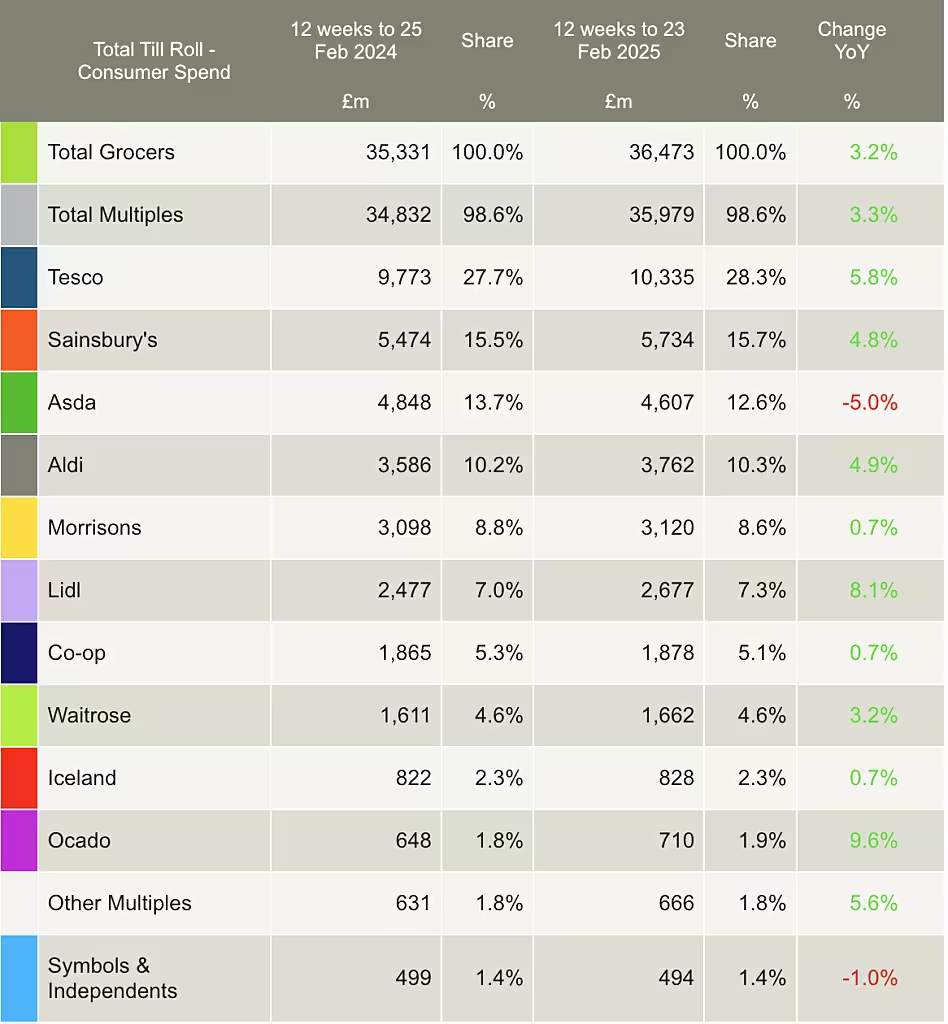

Tesco retained its position as the UK's top retailer with a 28.3% market share in the 12 weeks to 23 February 2025, while it achieved its highest sales growth of 5.8% since March 2024.

Sainsbury's emerged second with a market share of 15.7%, up from 15.5% in the same period last year.

Asda's market share stood at 12.6%, while Morrisons held 8.6% of the market.

Elsewhere, Ocado was the fastest-growing retailer for the tenth consecutive month with spending increasing by 9.6% – holding its share of the market at 1.9%, Kantar noted.

M&S continued its growth trajectory with grocery sales climbing by 12.2% across its bricks-and-mortar stores.

Convenience retailer Co-op continued to grow with a market share of 5.1%, while Waitrose’s sales increased by 3.2%, helped by almost 200,000 additional shoppers.

Spending at frozen food specialist Iceland was 0.7% higher, maintaining a share of 2.3% - the same as this time last year, Kantar added.