Grocery inflation in the UK hit a record 16.7% in the four weeks to January 22, dealing another blow to consumers battling an escalating cost-of-living crisis, Kantar data has revealed.

Kantar said grocery inflation was at its highest since it started tracking the figure in 2008, with prices rising fastest in markets such as milk, eggs and dog food.

It said UK households now face an additional £788 (€898) on their annual shopping bills if they don't change their behaviour to cut costs.

"Late last year, we saw the rate of grocery price inflation dip slightly, but that small sign of relief for consumers has been short-lived," Fraser McKevitt, Kantar's head of retail and consumer insight said, noting the figure jumped a "staggering" 2.3 percentage points from December's reading.

A Tighter Squeeze

After a tough 2022, British consumers are facing an even tighter squeeze on their finances this year, as government support on household energy bills is scaled back and mortgage rates rise.

The Bank of England is expected to raise its main interest rate by half a percentage point to 4% on Thursday.

Kantar said sales of supermarkets' own-label lines grew 9.3% in January, while sales of branded products, which are generally more expensive, were up by just 1.0%.

Trading Down

Market leader Tesco, Sainsbury's, and Morrisons have all said inflation for their customers is less than Kantar's headline number as they dial-out some of the hit through trading down to cheaper items.

With supermarkets focusing on price matching schemes and leveraging their loyalty programmes, the proportion of spending on promotions dropped to its lowest level since at least 2008, Kantar noted.

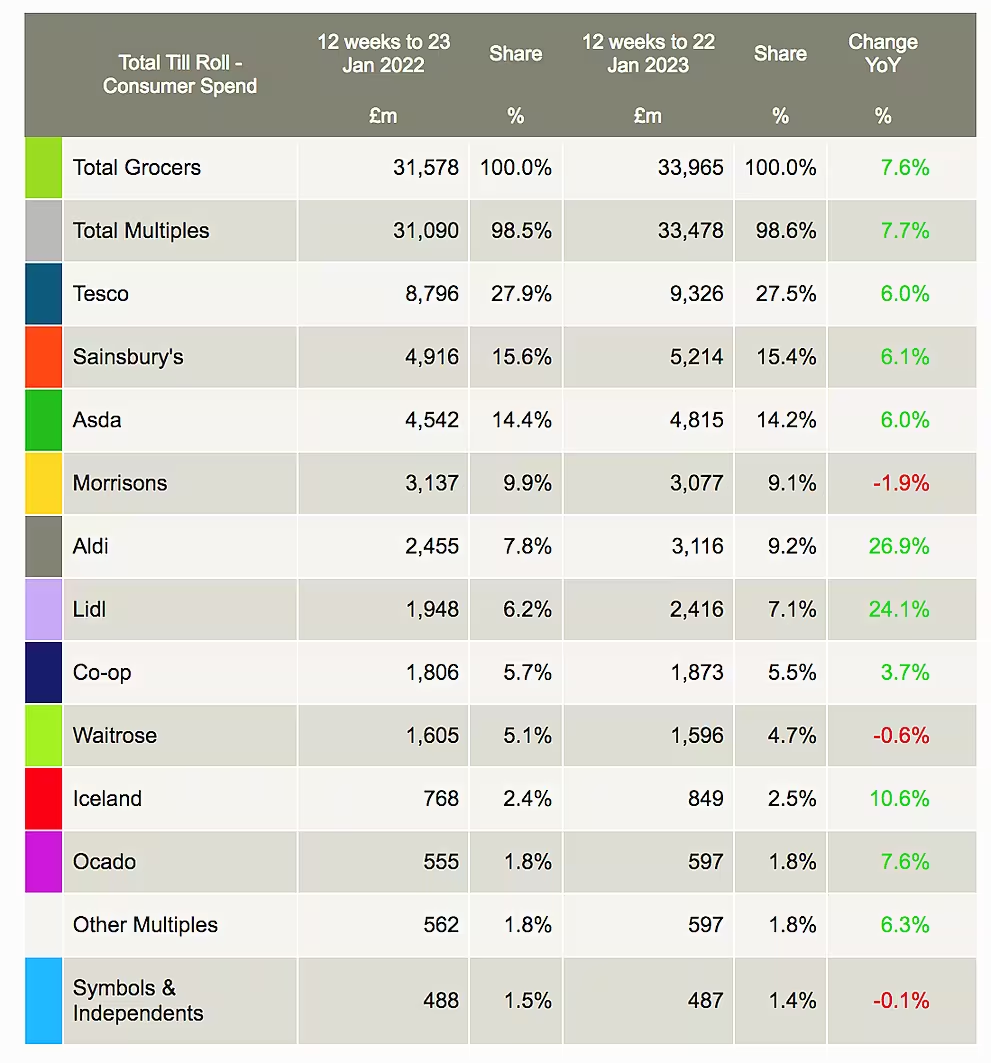

It said that over the 12 weeks to Jan. 22, UK grocery sales rose 7.6% year-on-year, masking a drop in volumes when accounting for inflation.

German-owned discounters Aldi and Lidl were again the fastest growing grocers, partly due to new store openings, with sales up 26.9% and 24.1% respectively.

Sainsbury's sales were up 6.1%, while sales at Tesco and Asda were both up 6.0%.

Although Morrisons was again the laggard, with sales down 1.9%, its performance continued to improve.

News by Reuters, edited by by ESM – your source for the latest retail news. Click subscribe to sign up to ESM: European Supermarket Magazine.