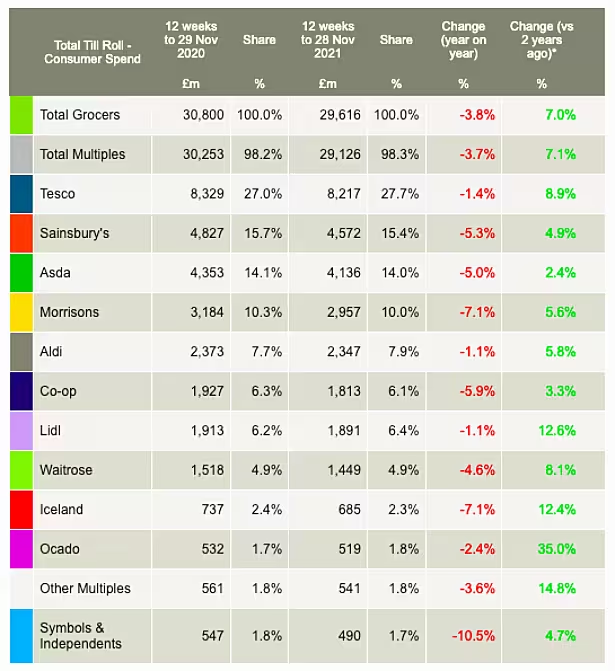

Grocery sales in the UK fell 3.8% in the 12 weeks to 28 November, new data from Kantar has shown, however sales compared to the corresponding period two years ago are up 7.0%.

According to Kantar, the dip in sales during the current period is due to the re-introduction of lockdown measures in the autumn of last year, which led to the closure of restaurants and bars, and subsequently more trade at the tills.

Different Set Of Circumstances

"Circumstances are very different this year," commented Fraser McKevitt, head of retail and consumer insight at Kantar.

"With people back in the office a few days a week and restaurants and cafés open, we’re putting less in our grocery baskets for cooking at home and as a result, the average shop size has shrunk by 8% this month versus last year.”

While all of the major grocers saw sales drop year-on-year, Tesco reported a softer decline (-1.4%) than the rest of the market – the UK market leader currently stands on 27.7% share, its highest market share since February 2019.

In terms of the remainder of the 'Big Four', Sainsbury's (15.4% market share) saw its sales down 5.3% compared to last year, Asda (14.0% market share) was down 5.0% year-on-year, while Morrisons (10.0% market share) was down 7.1% compared to last year.

Elsewhere, Aldi (7.9% market share) and Lidl (6.4% market share) both outperformed the rest of the market, with each seeing their market share dip by 1.1% compared to last year.

According to separate data from IGD, shopper confidence is also improving in the run up to Christmas.

Christmas Dinner Inflation

Elsewhere, Kantar noted that inflation is starting to have an effect on Christmas dinner staples, with the average cost of a festive meal for four now £27.48, which is 3.4% higher than last year.

The price of a frozen turkey has risen by 7%, Brussels sprouts are up 5%, Christmas pudding is up 5%, and Cauliflower is up 5%, Kantar said, however this is offset somewhat by cheaper prices for carrots (13% cheaper than last year), potatoes (5% cheaper) and cranberry sauce (3% cheaper).

"Across the board, grocery prices are up 3.2% in the latest four weeks, the highest rate of inflation we’ve recorded since June 2020," said McKevitt.

"Consumer behaviour hasn’t caught up with these changes, though. Habits we’d expect to see shift, like swapping branded products for own label or seeking out promotions, haven’t altered just yet.”

© 2021 European Supermarket Magazine – your source for the latest Retail news. Article by Stephen Wynne-Jones. Click subscribe to sign up to ESM: The European Supermarket Magazine.