Shoppers across the UK are visiting stores more often as the country's COVID-19 vaccination programme gathers pace, Kantar data has shown.

According to the data for the 12 weeks to 16 May, shoppers made 58 million more than they did at the same period last year. Consumer confidence remains high, having increased last month.

“As the vaccine rollout moves full steam ahead, consumers are getting more confident venturing back out to stores," said Fraser McKevitt, Kantar's head of retail and consumer insight. "The greatest acceleration has been in London, where trips are up by more than a quarter."

Retailer Performance

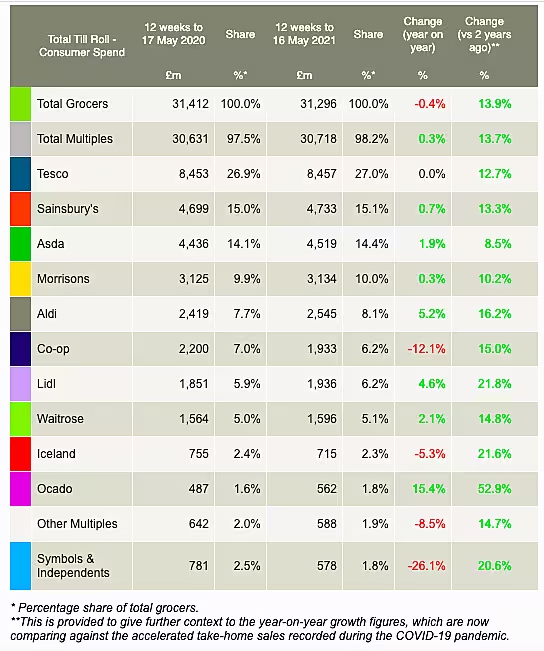

In terms of the performance of Britain's big four supermarket groups, Asda was the best performer, with sales up 1.9% year-on-year. Market leader Tesco's sales were flat, while Sainsbury's was up 0.7% and Morrisons was up 0.3%.

Ocado is the fastest-growing retailer, the data showed, with a market share gain of 0.2 percentage points in the period, however its sales growth has slowed 'substantially', Kantar said, and now stands at +15.4%.

Aldi and Lidl both grew ahead of the market this period and gained market share in the latest 12 weeks with take-home sales up by 5.2% and 4.6% respectively

Weekly Shop

Kantar said there were also signs that the big weekly shop, which made a comeback last year when Britons tried to reduce the time spent outside of their homes, may be on its way out.

It said average basket size fell for the third month in a row to £22.82 (€26.45), the lowest since March last year.

The proportion of supermarket sales made online, another hallmark of shopping habits last year, remained much higher than 2019 levels but fell back from 13.9% in April to 13.4% in the latest month.

Kantar said overall grocery sales fell 0.4% year-on-year over the 12-week period, reflecting a tough comparison with exceptionally high sales during the first three months of the pandemic in 2020. Compared to the same period in 2019 sales were up 13.9%.

"Many of us this time last year were eating all our meals at home and we bought extra food and drink as a result. Now we’re seeing take-home grocery sales dip versus 2020 as people are able to eat in restaurants, pubs and cafés and can pick up food on the go again," said McKevitt.

Kantar said grocery prices fell 1.2% over the 12-week period, the fastest fall since August 2016. Prices are rising fastest in segments such as chocolate confectionery, savoury snacks and canned colas while falling in bacon, toilet tissue and vegetables.

News by Reuters, edited by ESM. For more Retail news, click here. Click subscribe to sign up to ESM: European Supermarket Magazine.