Grocery sales felly by 1.9% in the UK over the 12-week period to 31 October, new data from Kantar has shown, with the research firm saying that post-pandemic shopping habits are 'beginning to settle'.

While grocery sales were down year-on-year, sales are still 7.3% higher than for the corresponding period in 2019.

'Bigger, Less Frequent' Shopping Trips

"The general trend towards bigger, less frequent trips to the supermarket seems set to stay," commented Fraser McKevitt, head of retail and consumer insight at Kantar.

"Households visited the supermarket 15.7 times in the past month on average. That’s a slight increase from the 15.3 trips we saw at this time in 2020, but consumers are still making 40 million fewer trips per month than they were in 2019."

According to McKevitt, as things stand, it will likely take three years before shopping patterns return to the way they were prior to COVID-19.

Online Shopping Levelling Out

Online grocery shopping also appear to have levelled out, with digital sales accounting for 12.4% of the total grocery market for the second month in a row, Kantar added.

"A fifth of households consistently order groceries online each month, becoming long term converts," said McKevitt.

Grocery inflation is also on the rise, running at 2.1% over the most recent four-week period; the highest rate since August 2020.

Performance Of The 'Big Four'

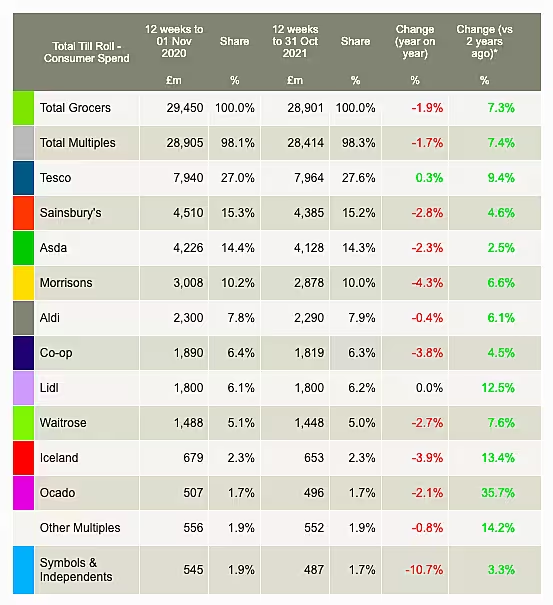

In terms of the performance of the UK's biggest grocers, market leader Tesco (27.6% market share) was the only retailer to post a year-on-year increase in sales in the 12-week period, by 0.3%.

According to Kantar, close to three quarters of the UK population visited a Tesco store over the most recent 12 months, helping it gain market share for the tenth period in a row. Tesco recently introduced a number of new shopping concepts, including a checkout-free store in London, and 10-minute deliveries in association with Gorillas.

As for the remainder of the Big Four, Sainsbury's (15.2% market share) saw sales down 2.8%; Asda (14.3% share) saw sales decline 2.3%; and Morrisons (10.0% share) was down 4.3%.

Elsewhere, discounter Lidl reported flat sales (0.0%) year-on-year, with both it and discounter rival Aldi increasing their share by 0.1 percentage points each.

© 2021 European Supermarket Magazine. Article by Stephen Wynne-Jones. For more Retail news, click here. Click subscribe to sign up to ESM: European Supermarket Magazine.