Sales of general merchandise at UK supermarkets fell 7% on the year in the four weeks to 2 December as shoppers looked to save money, delaying spending to take advantage of seasonal grocery promotions before Christmas, researcher NIQ said.

It said total sales growth at UK supermarkets slowed to 6.8% over the same period from 8.7% in last month's report.

Sales on a volume basis, or the number of items sold, were also weaker, down 0.9%.

Consumer Behaviour

The NIQ data going into December provides the most up-to-date snapshot of UK consumer behaviour.

In value terms, it said meat and poultry and confectionery were the fastest growing categories, with sales up 10.1% and 10.2% respectively.

Echoing data from rival market researcher Kantar last week, NIQ said sales made on promotion rose to 25%, the highest level since February 2020.

Mike Watkins, NIQ’s UK head of retailer and business insight said, “We know that almost three-quarters of households think retailer promotions are important when choosing where to make their grocery shop at Christmas.

“NIQ research also shows that loyalty points play a significant role in helping shoppers save money over the festive period with over half of shoppers look for personalised loyalty card prices and promotions and 38% cash in loyalty points saved throughout the year.”

Read More: Promotional Products Constitute Over A Quarter Of UK Grocery Baskets, Study Finds

Strongest Performers

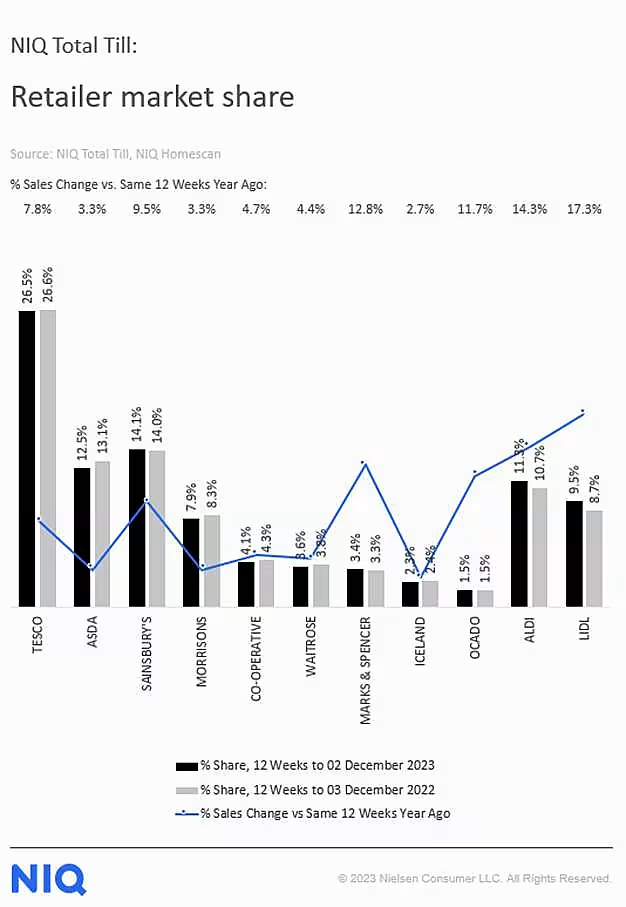

Discounters Lidl and Aldi were again the strongest performers over the 12 weeks to 2 December, with sales up 17.3% and 14.3% respectively, according to NIQ's figures.

Marks & Spencer was next with sales growth of 12.8%, followed by Ocado on 11.7%, Sainsbury's on 9.5% and market leader Tesco on 7.8%.

NIQ said UK shoppers were likely to spend up to £5 billion (€5.8 billion) over the seven days to 24 December, which, reflecting inflation, would be the biggest ever week for food sales.

Food price inflation was running at 7.8% in November, down from 8.8% in October, according to the researcher.

Watkins added, “The key for retailers is to get the basics right to dish up a successful Christmas; low price, quality, and availability are the top drivers that are important to shoppers when planning where to do their main Christmas grocery shop.”

News by Reuters, additional reporting by ESM.