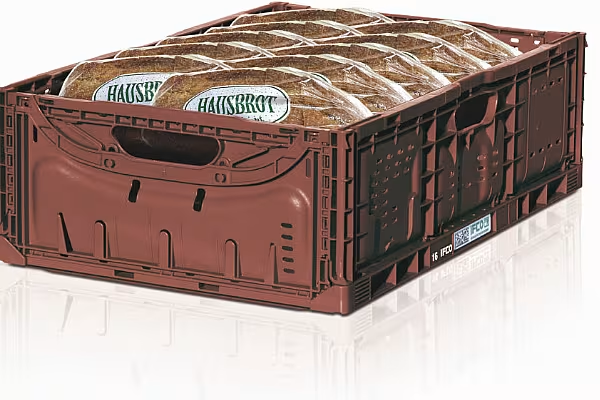

Logistics firm Brambles has announced that it has entered into a binding agreement for the sale of its IFCO reusable plastic container (RPC) business to Triton and Luxinva (a wholly-owned subsidiary of the Abu Dhabi Investment Authority), for $2.5 billion (€2.2 billion).

The transaction, which is subject to regulatory approval, is expected to be completed in the second quarter of this year.

Strategic Plans

"In August 2018, we announced that we would seek to separate IFCO through either a demerger or a sale by way of a dual track process," commented Brambles' chairman Stephen Johns.

"As well as progressing the demerger option, a robust and competitive sale process generated strong interest. We are pleased today to announce the sale of IFCO which we believe delivers greater value for shareholders, including a significant return of cash proceeds to shareholders."

IFCO generated revenues of $1.1 billion in 2018, as well as EBITDA of $248 million and underlying profit of $133 million.

Brambles said that it intends to return up to $1.95 billion of proceeds from the transaction to shareholders.

“The sale will allow Brambles to focus on our strategic priorities and to pursue continued revenue growth within our core markets, while also reviewing additional opportunities in emerging markets, through product and service innovation and use of technology through the supply chain," added Brambles CEO Graham Chipchase.

"Our ambition remains to lead the platform pooling industry in customer service, innovation and sustainability."

© 2019 European Supermarket Magazine – your source for the latest retail news. Article by Stephen Wynne-Jones. Click subscribe to sign up to ESM: European Supermarket Magazine.