Nick Peksa examines trends in the European dairy market, on the back of what has been an unpredictable couple of years, weather wise. This article first appeared in ESM Issue 4 2019.

During the recent school half-term, I volunteered to go on a camping trip with my youngest son. The aim was to go mountain biking in Wales, however, the rain arrived, so we decided to pack up and try to avoid it.

We headed north, through England and into the highlands of Scotland. The one thing that was consistent on the entire trip was the lush and verdant pasture that flanked the roads – a stark contrast to the arid grasslands of 2018. What a great time to be a dairy cow!

Excellent Pasture

Sadly, the purchase of milk and dairy products is slightly more complex than just looking at the quality of the grass. After all, the category is global, production quotas were removed in the EU, and demand for specific milk products is, at times, somewhat random. However, assessing the pasture is an excellent starting point.

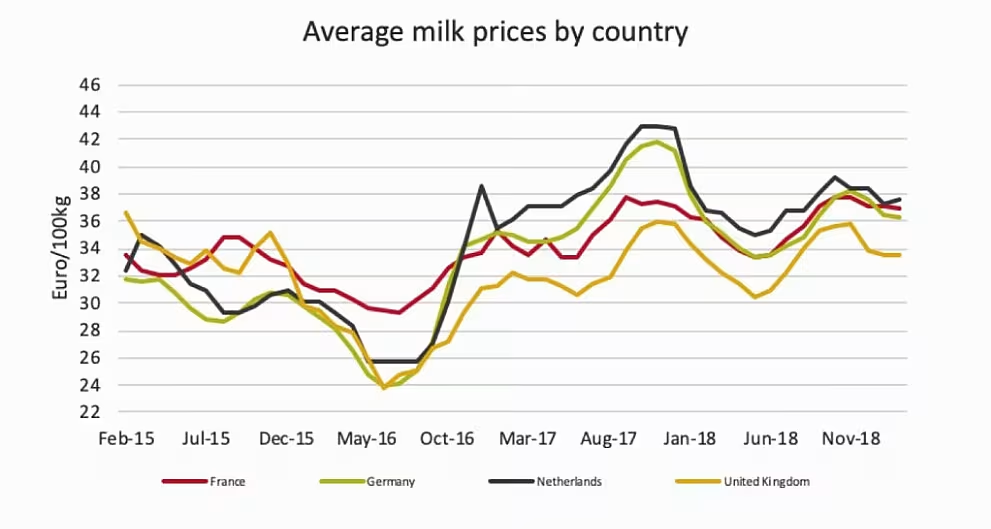

As previously mentioned, 2018 saw drought conditions in much of the prime pasture land of north-western Europe (UK, Germany, Denmark and Belgium). This trend has now been reversed, and thanks to excellent winter rain and mild spring temperatures, pasture productivity may rank extremely highly and may produce some of the best conditions of the last decade.

A factor that may affect milk supply is the reduction of herd size. In 2018, the number of dairy cows in the EU-28 stood at 22.9 million, a decrease of 1.6% from 2017. Germany is responsible for close to 18% of EU milk production, with 4.1 million active dairy cows, and the country recently announced a decrease in herd size of close to 100,000 head (2.3%).

The only significant increase in herd size was seen in Poland, with a year-on-year increase of 2.8% (61,000 cows).

Consumption of EU milk is expected to grow in line with production increases, however, the EU has recently experienced a surge in the export demand for skimmed-milk powder (SMP). This surge may encourage additional milk supplies to be diverted into powders, thus increasing raw-milk prices. In order to understand some of the reasons behind the recent increase in export demand, focus should be directed towards the major producing and exporting nations.

Milk Powders

In March, New Zealand milk production went down by 8.3% – the lowest milk production for this month since 2013. This is problematic, as New Zealand is the top global exporter of SMP. The production decrease in milk has been caused by the extended heatwave that began at the start of the year. Unlike Europe, the region remains dry.

On the back of tighter global supply and increased demand for milk powders from Asia, milk powder prices have been steadily increasing to coincide with New Zealand’s supply issues. More recently, the month of May saw SMP prices surge in Europe. This surge has been as a result of an increased demand for EU products, as buyers switched away from the Southern Hemisphere. Increased exports have depleted EU SMP stocks and, consequentially, forced prices to rise further.

Butter And Cheese

Most butter buyers are well covered with stocks, so prices have been decreasing. The May surge in SMP has stimulated further production, which, in turn, has resulted in increased supplies of EU butter and further supplemented stocks.

For the same reason, New Zealand has seen butter prices fall. There are indications that this market, in the midterm, may start its ascendancy. Australian butter is up 13%, and the US butter market has also started to climb.

Whilst the EU price is down 27%, compared to last year, price increases in the rest of the world might just stimulate future EU export demand.

On the plus side, there is limited volatility on cheese pricing in Europe, although the US is currently experiencing a number of price increases for Cheddar.

Cheese consumption is set to rise in Europe. In anticipation of this, Italy has already started to set aside more milk for cheese production.

Ending Thoughts

The benefit of great pasture and concentrated feeding should boost milk yields and counter-affect the reduction in herd size.

Overall, expectations will be for a year-on-year increase in European milk production, of 0.7%, however, any production increases might be nullified if the slow-down of global dairy production continues.

Asia may call upon European stocks to supplement regional shortfalls. If this happens, the net effect will be price increases for fresh milk and powders, with increases in cheese to follow in six to 12 months’ time.

For more information, contact nick.peksa@cost-insights.co.uk.

© 2019 European Supermarket Magazine – your source for the latest retail news. Article by Stephen Wynne-Jones. Click subscribe to sign up to ESM: European Supermarket Magazine.