When Kroger offered to buy Boxed Wholesale, founder Chieh Huang didn’t waste much time: Huang said he’d consider the offer and hopped on a plane to Seattle.

There Huang huddled with Amazon’s corporate development and consumer executives on Wednesday to discuss a potential sale, according to two people familiar with the matter.

Boxed’s chief executive officer, who has long insisted he wants to remain independent and eventually go public, now finds himself at a crossroads: help save an old-school grocer with 19th Century roots or hook up with the granddaddy of e-commerce.

Potential Deals

Boxed, which sells bulk-sized packages of paper towels, granola bars and maxi-pads, is considering the Kroger offer, two people familiar with the matter said. News reports of that offer accelerated conversations Boxed has been having with other potential buyers, including Amazon, said the two people, who asked not to be identified because the negotiations are private.

Amazon’s interest was reported earlier by the New York Post. Forbes earlier reported Kroger’s bid and said Boxed could fetch $325 million to $500 million without identifying the source of that estimate.

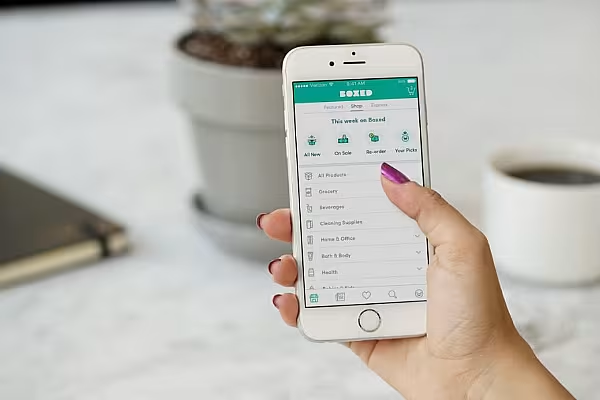

Boxed has differentiated itself from Amazon by offering a limited selection of products in bulk sizes, as well as an inexpensive house brand of trash bags, paper plates and other items. The narrower scope lets the company to sell more goods using fewer people and less space than a retailer with a larger inventory. Boxed declined to comment on the acquisition talks.

The New York-based startup has warehouses in New Jersey, Dallas, Las Vegas and Atlanta. It offers shoppers bulk-sized products like those found at Costco and other warehouse clubs, saving customers membership fees and the hassle of crowded parking lots and aisles.

Boxed said it had sales of about $100 million in 2016, up from about $50 million the previous year. The average order size was about $100 and included 10 items, meaning most orders met a $50 threshold for free shipping. The large average order appeals to companies looking for a cost-effective way to sell packaged household products online.

Seattle-based Amazon and Kroger, based in Cincinnati, declined to comment on the reports.

Tough Sell

Boxed could be an attractive buy for Kroger and other brick-and-mortar retailers that need help selling goods online, which requires strategically placed, efficient warehouses rather than stores close to customers. The grocer lost more than a quarter of its value within two days of the June announcement of Amazon’s $13.7 billion purchase of Whole Foods Market. Kroger has since recovered most of the loss.

It’s a tougher sell for Amazon, which has more than 300 million global customers lured by a quick, convenient delivery of an abundant online inventory, which includes most of the products Boxed sells.

Boxed has seen growing demand with businesses, which use its bulk-sizes to restock office pantries, an area Amazon is also targeting. Boxed also offers distribution centres specialised for the products commonly found in supermarkets. Amazon reinvigorated its push into the $800 billion grocery market last year with its acquisition of Whole Foods, giving it 460 stores around the country.

The e-commerce giant also been building new warehouses specialised for different types of products, with some facilities focused on small items and others big items like televisions and kayaks. Boxed could add more of these kinds of warehouses to increase efficiency.

Boxed also has strong relationships with consumer packaged goods companies such as Kraft Heinz and Procter & Gamble, which Amazon is also trying to cultivate to build its grocery business.

Boxed CEO Huang, 36, who started the company in his parents garage, has indicated he’d prefer to maintain a hands-on role after a sale. He made headlines in 2015 by offering to pay college tuition for his employees’ children and the following year offered as much as $20,000 to help employees pay for their weddings.

Amazon CEO Jeff Bezos has a tradition of buying companies and letting their founders continue to run them. Tony Hsieh continues to oversee Zappos.com, which Amazon purchased in 2009. Twitch Interactive CEO Emmett Shear remains in the role after Amazon purchased his video-game streaming site in 2014.

An acquisition by Kroger might put Huang more in the role of Jet.com founder Marc Lore, who is overseeing the digital transformation of Walmart Stores following the acquisition of his company.

News by Bloomberg, edited by ESM. Click subscribe to sign up to ESM: The European Supermarket Magazine.