British shoppers are increasingly shopping online, which could spell challenging times ahead for many high street retailers, according to the latest Office for National Statistics retail sales data for February 2018.

Online retail sales saw a 13.7% increase year-on-year, according to the data, with online food sales rising by 14.0% and non-food sales rising by 13.4%. Non-store retailing saw a 13.8% increase.

Online now accounts for 17.2% of total retail sales in the UK, the ONS data found, with 5.5% of food sales and 13.2% of non-food sales now taking place online.

Overall, year-on-year retail sales were up 1.5% in February, which is down on the 3.3% year-on-year increase recorded in February 2017. Price increases are visible across all retail sectors, however, this has slowed marginally since the start of the year: from 3.1% in December to 2.5% in February.

"Retail sales did grow in February, with increases seen in food, non-store and fuel, but this followed two months of decline in these sectors," commented Rhian Murphy, ONS Senior Statistician. "However, the underlying three-month picture is one of falling sales, mainly due to strong declines across all main sectors in December."

"Store prices continue to rise across all store types, but at a lower rate than the previous month due to a slowdown in price growth, though clothing and household goods stores continued to see stronger price rises."

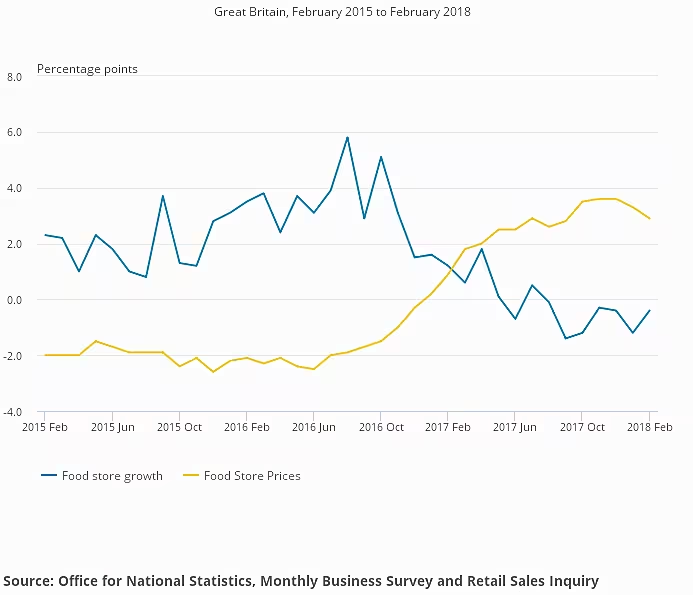

In food retail in particular, February 2018 marked the seventh consecutive monthly decline in terms of volumes purchased, a period that has coincided with increases in food store prices.

Year-on-year value sales at food retailers were up 0.9% for the period, while volumes were down 0.2%, again perhaps due to increased food prices at the checkout.

A Clear Trend

Commenting on the ONS figures, David Jinks, head of consumer research at e-commerce delivery firm ParcelHero said that there is now a degree of inevitability about the rise of online, and its impact on the bricks and mortar retail environment.

"Online stores are continuing to eat High Street stores’ lunch, and there seems no end to the problems facing many famous retail names," he commented.

"This year we have seen Toys R Us and Maplin electronics fail, and Claire’s Accessories, Mothercare, New Look, Bargain Booze, Wine Rack and Poundstretcher are faltering in various ways. It’s no coincidence that this is happening at a time when e-commerce stores from Amazon to ASOS to Ocado all report healthy results."

A saving grace for the high street, Jinks argued, could be with department stores, which posted a 20.7% year-on-year increase in February, with many major players switching to a multichannel approach.

"It looks like it’s being left to department stores such as John Lewis to show how a High Street store with a reputation for quality service can carry that over into its online offering," he said. "Other retailers have to get this right, or this year’s list of failures could become catastrophic."

Make It Count

Research from Shoppercentric, a shopper research firm, has indicated that a number of factors have impacted traditional bricks and mortar operators, such as the weather, the forthcoming Brexit, and retail competition, and it is now more important that ever for retailers to come up with strategies to encourage shoppers back to their stores.

"Retailers need to be clear on how they are going to attract shoppers to their stores, and how they are going to encourage them to buy something once they are through the door," said Danielle Pinnington, Shoppercentric's managing director.

Pinnington added that the improving results from Tesco and Morrisons indicate that the solution doesn't lie in a race to the bottom on price.

"This is about understanding what today’s shoppers want from the stores they choose to visit, understanding how they make their purchase decisions and the factors that can influence them, delivering against those needs, and being ready to flex when those needs change."

© 2018 European Supermarket Magazine – your source for the latest retail news. Article by Stephen Wynne-Jones. Click subscribe to sign up to ESM: The European Supermarket Magazine.