If the world's biggest tobacco firms are correct, the expression "lighting up a cigarette" may take on a whole new meaning in the coming years.

The rise of vaping devices, coupled with the introduction of packaging restrictions in major markets, had led major firms such as Japan Tobacco, Philip Morris and Imperial Brands to invest more and more in the emerging HNB (Heat-not-Burn) sector, which offer adult smokers the nicotine hit they have become used to, without an important element - combustion.

The new chief executive of Japan Tobacco Inc, Masamichi Terabatake, who took charge at the world's third biggest listed tobacco maker earlier this month, has stated that he wants the Silk Cut owner to command as much as a 40% share of the heated tobacco market in Japan by the end of the decade, with its Ploom Tech device at the heart of this growth.

Terabatake also believes that the level of adoption of these new devices in the Asian country is such that the heated tobacco market will comprise about a third of Japan’s overall tobacco market by 2020.

“To grow sustainability, we need to strengthen our portfolio for the future. So we’ve been actively changing our mode, focusing on the emerging markets," Bloomberg reported him as saying.

“There’s a lot of white space and places we don’t have market share. If we don’t build a foundation in those spots for 10 to 15 years in the future, it will be problematic.”

Legislation

Of course, Japan Tobacco isn't alone in this endeavour. British American Tobacco's Glo and Philip Morris' iQOS have already ploughed a furrow for others to follow.

iQOS, in particular, is currently used by around four million consumers in 30 markets around the world, with Philip Morris claiming that the device delivers up to 95% fewer harmful chemicals than the smoke generated by traditional cigarettes.

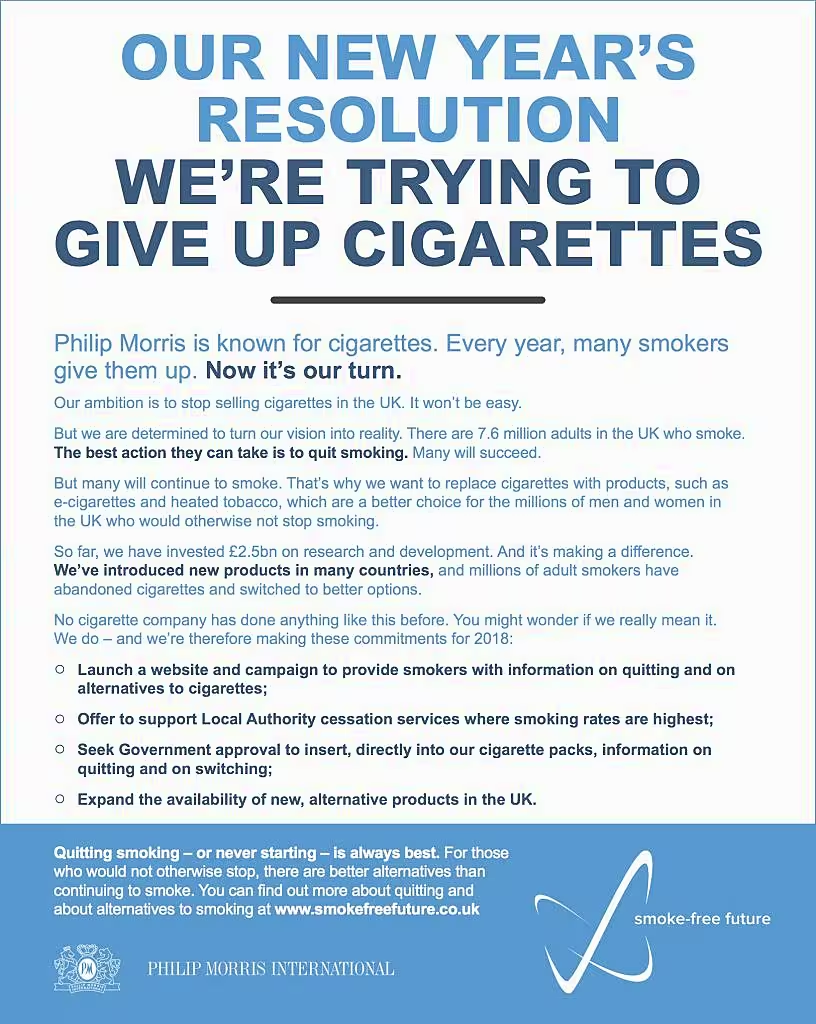

Earlier this month, the tobacco company took a full page ad in several UK newspapers (see below), in which it announced its New Year's Resolution - to 'give up' cigarettes.

"No tobacco company has done anything like this before," the ad reads. "You might wonder if we really mean it. We do."

Later today, Wednesday 24 January, the US Food and Drug Administration is expected to vote on whether Philip Morris will be able to sell its product in the US, and recommend whether the product's 'modified risk' claims are valid.

The FDA had already stated last summer that it is looking to reduce the content of nicotine levels in cigarettes, while also increasing the development of lower-risk alternatives.

Philip Morris claims that iQOS is just the answer, however health lobbyists have suggested that 'Big Tobacco' should not be trusted with delivering a solution to a problem of its own making.

Tax Talks

Regardless of the FDA's decision, one outcome for HNB products appears likely: tax levels on said products are likely to be on a par with traditional tobacco products in markets in which they are available.

In November, South Korea passed legislation to increase the excise taxes on HNB products to 89% of traditional products. And in December, Japan's government followed suit, saying that it plans to tax HNB products at around 80% of the level of cigarettes and other tobacco products.

As Wells Fargo analyst Bonnie Herzog said at the time, "By proposing to tax HNB products at 80% of conventional cigs, the Japanese gov’t is acknowledging to some extent HNB’s lower relative risk profile. Further, the proposed new tax methodology on HNB products is essentially leveling the playing field."

However, she added that while the tax benefit "may eventually evaporate in some markets, we believe many markets will continue to retain some level of tax advantage on reduced risk products which we believe is positive for global public health & the tobacco industry."

Getting FDA clearance in the US could represent an important next step in the development of this growing market.

© 2018 European Supermarket Magazine – your source for the latest retail news. Article by Stephen Wynne-Jones. Click subscribe to sign up to ESM: The European Supermarket Magazine.