Two thirds of UK shoppers visited an Aldi or Lidl outlet in the 12 week period to 30 December, according to Kantar Worldpanel’s market share figures for the period.

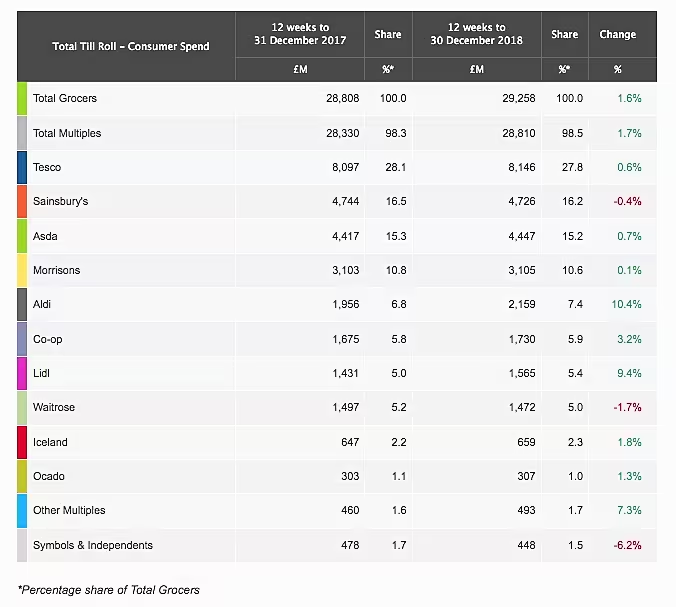

Aldi posted sales growth of 10.4% for the period, while Lidl saw growth of 9.4%, as the discounters outperformed their peers in the busiest shopping period of the year.

Aldi and Lidl hold 7.4% and 5.4% of the UK market respectively, according to Kantar Worldpanel.

Commenting on the discounters’ performance, Fraser McKevitt, head of retail and consumer insight at Kantar Worldpanel said. “Aldi narrowly won the crown of the fastest-growing supermarket and it appears its marketing efforts are paying off – at least when it comes to vegetables. The return of Kevin the Carrot contributed to an 18% increase in carrot sales and nearly one in five households bought the vegetable at the discounter.”

Market Leaders

Tesco continues to lead the UK grocery market, with 27.8% market share, having seen an 0.6% increase in sales in the 12-week period.

Second-placed Sainsbury’s saw a slight lapse in sales (-0.4%) in the period to sit on 16.2% market share, while Asda, in third, holds 15.2% market share, on the back of a 0.7% sales increase.

Fourth-placed Morrisons, which issued a trading statement today, saw a 0.1% sales increase to sit on 10.6% market share.

Festive Sales Boost

According to Kantar Worldpanel, UK supermarkets posted sales of £29.3 billion over the Christmas trading period, benefiting from lower inflation.

This means that UK shoppers spent £450 million more in the most recent Christmas, compared to the previous year.

“Despite the supermarket sector growing at 1.6% – its slowest rate since March 2017 – the retailers clocked in another record-breaking Christmas as households racked up an average spend of £383 in grocery bills for the month of December,” said McKevitt.

“Saturday 22 December proved to be the busiest shopping day of the year: more than half of all households visited one of the grocers in a last-minute Christmas dash, with 1.7 million additional customers walking through the aisles compared to the Saturday before.”

© 2019 European Supermarket Magazine – your source for the latest retail news. Article by Stephen Wynne-Jones. Click subscribe to sign up to ESM: European Supermarket Magazine.